Unraveling the Enigma: Plaintiff Investment Funding LLC – A Deep Dive into its Operations, Strategies, and Impact

Plaintiff Investment Funding LLC, a name that may not resonate with the average individual, operates within a niche sector of the financial landscape. This in-depth analysis seeks to illuminate the entity’s operations, investment strategies, the types of cases it funds, and its broader impact on the legal and financial systems. Understanding Plaintiff Investment Funding LLC requires examining its role in the litigation finance ecosystem, its risk assessment methodologies, and the ethical considerations inherent in its business model.

Understanding Litigation Funding

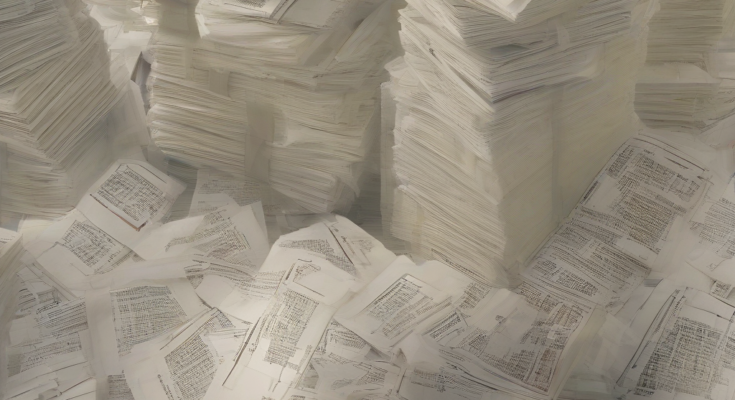

Before delving into the specifics of Plaintiff Investment Funding LLC, it’s crucial to understand the broader context of litigation funding. Litigation funding is the practice of providing financial support to plaintiffs pursuing legal action, particularly in cases with significant financial implications and substantial upfront costs. These cases often involve complex litigation, such as class-action lawsuits, patent disputes, or commercial disputes. Traditional funding routes may be inaccessible to plaintiffs who lack the resources to finance lengthy and expensive legal battles. This is where litigation funders, like Plaintiff Investment Funding LLC, step in.

- Bridging the Funding Gap: Litigation funders provide the necessary capital to cover legal fees, expert witness expenses, and other litigation costs. This allows plaintiffs to pursue meritorious claims that they might otherwise be forced to abandon due to financial constraints.

- Contingency-Based Model: The funding arrangement is typically contingent on the outcome of the case. Funders receive a predetermined percentage of any financial recovery or settlement, often significantly less than the amount recovered by the plaintiff. If the case is unsuccessful, the funder receives no return on its investment.

- Risk Assessment and Due Diligence: Litigation funders conduct thorough due diligence on cases before committing funds. This includes evaluating the merits of the claim, the strength of the evidence, and the potential for a successful outcome. This rigorous process aims to mitigate the risk of investment loss.

Plaintiff Investment Funding LLC’s Operational Model

While specific details about Plaintiff Investment Funding LLC’s internal operations are often kept confidential due to competitive reasons and the sensitive nature of the cases they fund, we can analyze its probable operations based on industry standards and publicly available information. It likely employs a team of legal professionals, financial analysts, and investment specialists who collaborate to evaluate potential funding opportunities.

- Case Selection Process: The firm likely prioritizes cases with a strong likelihood of success, significant potential recovery, and a clear path to realizing a return on investment. This involves a detailed review of the legal arguments, evidence, and the opposing party’s resources.

- Due Diligence and Risk Mitigation: Plaintiff Investment Funding LLC likely utilizes sophisticated risk assessment models to determine the level of risk associated with each potential investment. This includes evaluating the legal landscape, the strength of the plaintiff’s case, and the potential for appeals.

- Investment Structure and Agreements: The firm likely negotiates customized funding agreements with each plaintiff, specifying the amount of funding, the percentage of the recovery the funder will receive, and the terms of the repayment.

- Portfolio Management: Similar to any investment firm, Plaintiff Investment Funding LLC likely actively manages its portfolio of funded cases, monitoring their progress, and making adjustments as needed.

Types of Cases Funded

Plaintiff Investment Funding LLC’s portfolio probably encompasses a diverse range of cases, reflecting the broad spectrum of litigation that requires external funding. Based on industry trends, some potential areas of focus could include:

- Class-Action Lawsuits: These lawsuits involve a large group of plaintiffs with similar claims against a common defendant. Such cases often require substantial upfront investment and can yield substantial returns if successful.

- Commercial Disputes: Disputes between businesses, involving contract breaches, intellectual property infringements, or other commercial disagreements, often necessitate litigation funding due to high legal costs.

- Patent Litigation: Patent disputes are notoriously expensive and can take years to resolve. Litigation funding can be crucial for plaintiffs seeking to protect their intellectual property rights.

- Personal Injury Cases: While less frequently funded compared to commercial cases, significant personal injury cases with high damages potential might attract funding, particularly those involving complex medical evidence.

Ethical Considerations and Regulatory Landscape

The litigation funding industry is not without its ethical considerations. Critics raise concerns about the potential for funders to influence legal strategies, the transparency of funding arrangements, and the impact on access to justice. The regulatory landscape for litigation funding varies significantly across jurisdictions, with some countries having more robust regulations than others.

- Transparency and Disclosure: Concerns exist about the lack of transparency in some funding agreements. Clear and open disclosure of the funding arrangement to courts and opposing parties is crucial for maintaining fairness and ethical conduct.

- Potential for Conflicts of Interest: Critics argue that litigation funders may have incentives to pursue cases that maximize their returns, potentially at the expense of the plaintiff’s best interests.

- Access to Justice: While litigation funding can expand access to justice for plaintiffs who lack resources, concerns remain that it could exacerbate existing inequalities in the legal system, benefiting those with the most compelling cases.

- Regulatory Scrutiny: The regulatory landscape for litigation funding is still evolving. Governments worldwide are grappling with how best to regulate this sector while balancing the benefits of expanding access to justice with the need to prevent potential abuses.

Impact on the Legal and Financial Systems

Plaintiff Investment Funding LLC, and litigation funders in general, have a demonstrable impact on the legal and financial systems. Their role in financing litigation impacts case outcomes, settlement negotiations, and the overall efficiency of the legal process.

- Increased Access to Justice: Litigation funding provides a crucial lifeline for plaintiffs with meritorious claims but limited financial resources, thereby leveling the playing field in some cases.

- Influence on Settlement Negotiations: The presence of a funder can influence settlement negotiations, potentially leading to higher settlements for plaintiffs. Funders have a vested interest in securing a favorable outcome.

- Impact on Case Outcomes: While not directly influencing the judicial process, funding can impact the duration and outcome of litigation, as plaintiffs with access to adequate funding are better equipped to pursue their claims effectively.

- Evolution of the Legal Profession: The rise of litigation funding has led to a notable shift in the dynamics of the legal profession, with lawyers increasingly working with funders to secure funding for their clients.

Future Trends and Challenges

The litigation funding industry is dynamic and constantly evolving. Several trends and challenges are shaping the future of Plaintiff Investment Funding LLC and similar entities:

- Increased Regulatory Scrutiny: As the industry matures, it is likely to face increasing regulatory oversight aimed at ensuring ethical practices and preventing potential abuses.

- Technological Advancements: Technology is likely to play an increasingly important role in litigation funding, with sophisticated data analytics and predictive modeling being employed to assess risk and evaluate potential investments.

- Global Expansion: Litigation funding is expanding globally, with new players entering the market in various jurisdictions. This expansion presents both opportunities and challenges for existing funders.

- Competition and Consolidation: Increased competition among litigation funders may lead to consolidation within the industry, with larger players acquiring smaller firms.

In conclusion, Plaintiff Investment Funding LLC operates within a complex and evolving landscape. A thorough understanding of its operations, strategies, and impact requires considering the broader context of litigation funding, its ethical implications, and the regulatory environment. As the industry continues to develop, the role of litigation funders like Plaintiff Investment Funding LLC will undoubtedly continue to shape the legal and financial systems.